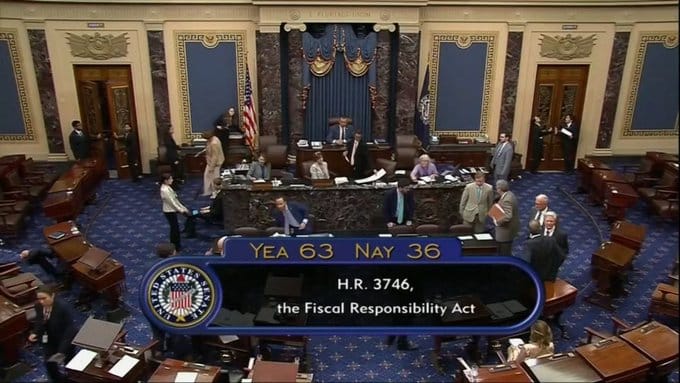

The Senate voted 63-36 late Thursday to give final approval on the deal to suspend the debt ceiling, averting by less than four days what Treasury Secretary Janet Yellen had warned would be economic “catastrophe.”

The deal had been negotiated and agreed to on Saturday by President Biden and House Speaker Kevin McCarthy (R-CA). It suspends the debt ceiling beyond next year’s presidential election into 2025. It also caps spending in the 2024 and 2025 budgets, claws back unused Covid pandemic funds, speeds up the permitting process for some energy projects, and include extra work requirements for aid programs like food stamps, though overall funding is mostly held flat for domestic programs.

The Senate had gone into session Thursday without a clear timeline on when it would vote because a number of amendments to the House bill had been proposed—mostly by Republican Senators.

All 11 amendments introduced on the Senate floor Thursday failed to pass.

In the end, four Democrats, 31 Republicans and one Independent (Sen. Bernie Sanders of Vermont) voted against the deal in the Senate.

Ahead of the Senate vote, Majority Leader Chuck Schumer (D-NY) said that passing the bill means, “America can breathe a sigh of relief.”

After the Senate’s vote he said, “We’ve saved the country from the scourge of default.”

Senate Minority Leader Mitch McConnell (R-KY) called the deal’s passage”an important step toward fiscal sanity.”

The bill now heads to President Biden’s desk, where he will sign it into law as soon as possible.

“No one gets everything they want in a negotiation, but make no mistake: this bipartisan agreement is a big win for our economy and the American people, Biden said late Thursday. “Our work is far from finished, but I look forward to signing this bill into law as soon as possible and addressing the American people directly tomorrow.”

Friday’s stock futures rose as traders cheered the debt deal’s passage.

Treasury Secretary Janet Yellen had warned that without lifting the debt ceiling, the government would completely run out of money and default on its financial obligations on Monday.