Unemployment to Steady Despite Economic Slowdown

This post was originally published on this siteUnemployment will stay mostly stable around the world this year and next despite a sharp economic slowdown, the International Labour Organization said.

30 dead in Russian missile strike on Ukraine apartments; Zelenskyy vows revenge: Updates

This post was originally published on this siteThe explosions Saturday smashed through all nine floors of a building in Dnipro, Ukraine, that housed an estimated 1,700 people. Sunday updates.

Affordable Care Act open enrollment ends Sunday amid record sign-ups

Those who want Affordable Care Act coverage for 2023 have only a few days left to sign up. Open enrollment ends on Sunday, January 15 on the federal exchange and most state-based marketplaces.

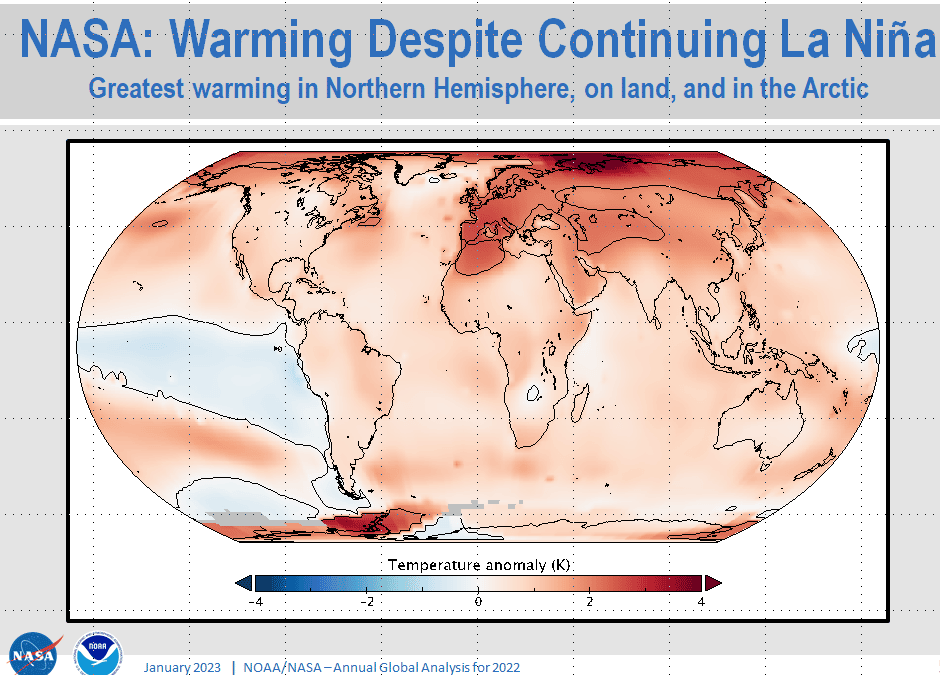

Feds release bleak 2022 climate change data: Oceans warm, global temps among hottest on record

This post was originally published on this siteNASA and NOAA released the global temperatures for 2022 and other records from the warming climate. Temperatures were among the warmest on record.

Bill To Bar U.S. From Selling Oil Reserves to China Passes House With Bipartisan Support

This post was originally published on this siteThe House on Thursday passed a bill that bars the United States from selling its oil reserves to China, a move that comes after the Washington Free Beacon exposed the Biden administration”s decision to sell nearly one million reserve barrels to a Chinese oil giant. The bill received […]

What will U.S. house prices look like in 2023?

Amid peaking prices due to inflation and murmurs of an upcoming recession, you might be wondering: What’s up with the housing market for 2023? Mortgage rates started to decline in the final weeks of 2022, and demand for housing is similarly expected to fall in the new year. Price growth is also expected to cool — though by how much remains unclear. Whether you’re a hopeful buyer or seller in 2023, or just someone who likes to keep tabs on the housing market, here’s a closer look at what to expect this year.

Where are housing prices headed in 2023?

Expect to see home prices continue to decline in 2023 from their recent record highs. Whether that cool-off will be a slow descent or a sudden drop is up for debate. Per Forbes, “[t]here are mixed signals from economists about if and when the housing market will crash, or if it will simply ‘correct’ itself from the double-digit percentage jumps seen in home prices the past year.”

A crash would mean a 20 to 30 percent drop in home prices, but some experts argue that the symptoms of that happening soon aren’t there yet. Rather, Rick Sharga, executive vice president of market intelligence at ATTOM Data, told Forbes that he estimates “about a 5 percent drop nationally,” with some markets continuing to see price increases. Kiplinger, meanwhile, predicts that “house-price growth will likely slow down to a 7 percent annual rate by year-end.”

What about mortgage rates?

As many potential homebuyers are likely well aware, mortgage rates shot sky-high in 2022 as the Federal Reserve hiked rates in an effort to control inflation. But toward the end of 2022, rates finally started to decline — and it’s expected that trend could continue in 2023.

Kiplinger explains that this drop was in reaction to the recent decline in the 10-year Treasury yield. However, mortgage rates remain “about a full percentage point higher in relation to the 10-year Treasury than would normally be expected.” This could be a positive sign of things to come, at least for mortgage rates, as Kiplinger notes that “[m]ortgage rates tend to stay higher for longer when inflation is high, whereas Treasury rates tend to be more sensitive to signs of economic slowing.”

What will housing inventory look like this year?

If you’re hoping for a plethora of options as a home shopper in 2023, you might not find them. This is likely the case for existing homes, but perhaps even more so for new builds.

Forbes notes that “those who purchased homes in recent years at extremely low mortgage rates are staying put,” evidenced by a steady decline in existing home sales in the past year. However, Kiplinger argues that there could be a chance for a recovery in existing home sales by the end of the year if home affordability improves as anticipated.

The picture is less rosy when it comes to new builds. Even though new home sales increased somewhat toward the end of 2022, Kiplinger reports that inventory may not pan out, given “an elevated share of that inventory is homes where construction has not yet started, and those projects may not materialize, given the weak conditions in the housing market.”

Housing starts continued to tumble toward the end of 2022, particularly for single-family homes. Builders might continue to hold off in 2023 “amid soaring mortgage rates and elevated costs for building materials,” according to Kiplinger.

Is this year a good time to buy a house?

While you might be hoping for a simple yes or no, the answer to this question is highly personal. It really depends on what your current financial situation is and what your needs are. Here are four questions to ask as you decide:

Are you ready to commit to a location?

Buying a house is a commitment — typically, it’s recommended that you stay in a house for at least five years to offset the costs of the transaction, per Kiplinger. While people can and absolutely do end up selling sooner than that, it’s better to ask yourself if you’re really serious about settling down in a particular place before you buy.

What’s your budget?

Before you get carried away with favoriting pretty homes on Zillow, see what’s financially feasible. If you’re already stretched thin, adding a mortgage to the mix likely isn’t a great idea. And then there’s also the question of how much you can spend on a home, taking into consideration that home ownership also involves costs like heating and cooling, water, etc. One trick Kiplinger offers for figuring this out: “Lenders usually require that the principal, interest, taxes, and insurance expenses be less than 28 percent of your monthly gross income.”

Have you saved up for a down payment?

Even if you take out a mortgage, you’ll still have to put some money down to purchase a home. The minimum required down payment is generally 3 percent, though Kiplinger says that “typical new home buyers put down 6 percent, on average.” But if you want to avoid private mortgage insurance getting tacked onto your already stiff monthly mortgage payments, you’ll need to put down at least 20 percent.

How’s your credit score?

Having a solid credit score is key to getting approved for a mortgage and securing a competitive rate. According to Kiplinger, lenders generally look for a credit score that is at least over 670. If your credit score has some room for improvement, it makes sense to do that before applying for a mortgage. A couple easy ways to boost your credit score include paying your bills on time and maintaining a credit utilization ratio below 30 percent.

Nebraska Gov. Pillen appoints Pete Ricketts to Sasse’s Senate seat

Nebraska Gov. Jim Pillen on Thursday said he is appointing former Gov. Pete Ricketts to fill the Senate seat left vacant by Republican Ben Sasse’s resignation.

Inflation slowed to 6.5 percent in December: CPI

This post was originally published on this siteConsumer prices slowed further in December, boosting hopes that the worst of red-hot inflation is behind the U.S. The annual inflation rate fell from 7.1 percent in November to 6.5 percent in December, according to the consumer price index, released Thursday morning. Prices fell 0.1 percent last month […]

Everything you need to know about the new student loan payment proposal

The Biden administration has released a new student loan repayment plan that is expected to make college “more affordable and manageable than ever before.” Here’s everything you need to know:

What are the details of the plan?

The Department of Education (DOE) called the new plan a “student loan safety net” that prevents borrowers from being overwhelmed by debt, per The Associated Press. It revises one of the current income-driven payment plans known as REPAYE, where monthly payments are determined by the borrower’s income and then the remaining loan is forgiven after 20 years. The Education Department’s updated plan would make the process more forgiving, The New York Times explains.

First, undergraduate loan payments would be reduced to 5 percent of discretionary income, compared to 10 percent in the old REPAYE plan. Discretionary income is the amount of money left over after paying expenses. Graduate loan debt would be set at 10 percent of discretionary income, but if you have both, it would be weighted.

Low-income borrowers might also be eligible for $0 monthly payments if they are not making 225 percent of the federal poverty level. “That means a single borrower earning less than $30,500 a year and a borrower in a family of four making less than $62,400 would not be required to make monthly payments on their loans,” The Washington Post reports. Additionally, those who took out smaller loans would also have their debt forgiven in 10 years, rather than in 20 years.

The biggest change is that the borrower’s loan balance would not increase over time, even if they currently are not making payments.

It is not yet clear when the new plan would be implemented.

What kind of savings would you see?

The most significant savings would go to those with undergraduate debt, since their monthly payments would be reduced. “These proposed regulations will cut monthly payments for undergraduate borrowers in half and create faster pathways to forgiveness, so borrowers can better manage repayment, avoid delinquency and default, and focus on building brighter futures for themselves and their families,” said Education Secretary Miguel Cardona.

Also, low-income borrowers would pay an average of “83 percent lower per dollar borrowed over their lifetimes,” writes the Times. High-income earners would see a 5 percent decrease in payments. “We are, for the first time, creating a true student-loan safety net in this country,” Undersecretary of Education James Kvaal told reporters.

What are the criticisms of the program?

The Office of Federal Student Aid (FSA) has been vocal about the pressure it would face implementing the new plan. The FSA and DOE “must now safeguard priorities … while also scrambling to find hundreds of millions of dollars to cut from other current and future programs,” according to NPR.

This is because Congress’ omnibus spending bill did not allocate enough for the FSA to fulfill everything on its agenda. In 2022, the FSA had a budget of $2 billion; in the original 2023 budget proposal, the Biden administration wanted to raise the budget to $2.65 billion. Republicans counteroffered with a 20 percent increase for the FSA, which was lower than what the administration wanted, but still an increase. “There was a proposal put forward to the White House to say, ‘Listen, we’ll give you an extra couple hundred million dollars here, in order to focus on improvements … for the student loan program,'” a source told NPR. “But that came with a tradeoff.” The tradeoff was that none of the funding could go to Biden’s loan relief program.

In turn, the Senate version of the bill provided “no new funding for the implementation of the Biden administration’s student loan forgiveness plan.” Democrats did not want an exception like that specifically noted, and rejected the proposal. Republicans “refused to agree to additional money for FSA without a debt relief exception,” explains NPR. As a result, the agency received the same budget as last year, with more agenda items to cover.

Another concern is that the debt relief program will subsidize predatory schools “because borrowers with the lowest earnings — perhaps because they graduated from, or left, poor-performing programs — receive some of the biggest benefits,” MarketWatch explains. As Kvaal echoed, “It’s time to name names about these programs and have a frank conversation about the root causes of student debt.”

The House Rules: Which Matter, Which Don’t

This post was originally published on this site The House of Representatives on Monday evening passed a much-discussed rules package, which was the subject of extensive negotiation between House Speaker Kevin McCarthy (R., Calif.) and the GOP holdouts who eventually helped to elevate him. But which of these rules will matter in practice? Which are […]

Tagged House of RepresentativesHouse Rules